Lesson – Net Price Calculator

Module 7: Unit 5

The Net Price Calculator

The Net Price Calculator provides an estimate, based on a school’s financial aid policies, of what it will cost you to attend college for one academic year. Your ‘Net Price’ has less to do with the total cost of a college and more with the financial aid policies of the college. The net price for a $20,000 college may be $10,000, while the net price for a $70,000 may be $5,000.

Step 1: Ensure that you are logged into the Google Account used for our program. Click here to log into an existing Google account or to establish an account.

Step 2: Open or Create your College Scorecard Comparison Sheet document

- Click here to create a ‘College Scorecard Comparison Sheet’ document (Note: The original document cannot be edited).

- Select the ‘File’ menu on the top left of the document.

- Select ‘Make a copy’ from the File Menu.

- Replace ‘Copy of Your Name’ in the name of the document with your first and last name (properly capitalized).

- Select ‘SHARE’ to confirm that the document has been shared to cpc@collegeplanningcohort.com. You may also add the email address of your parent, mentor, or college adviser.

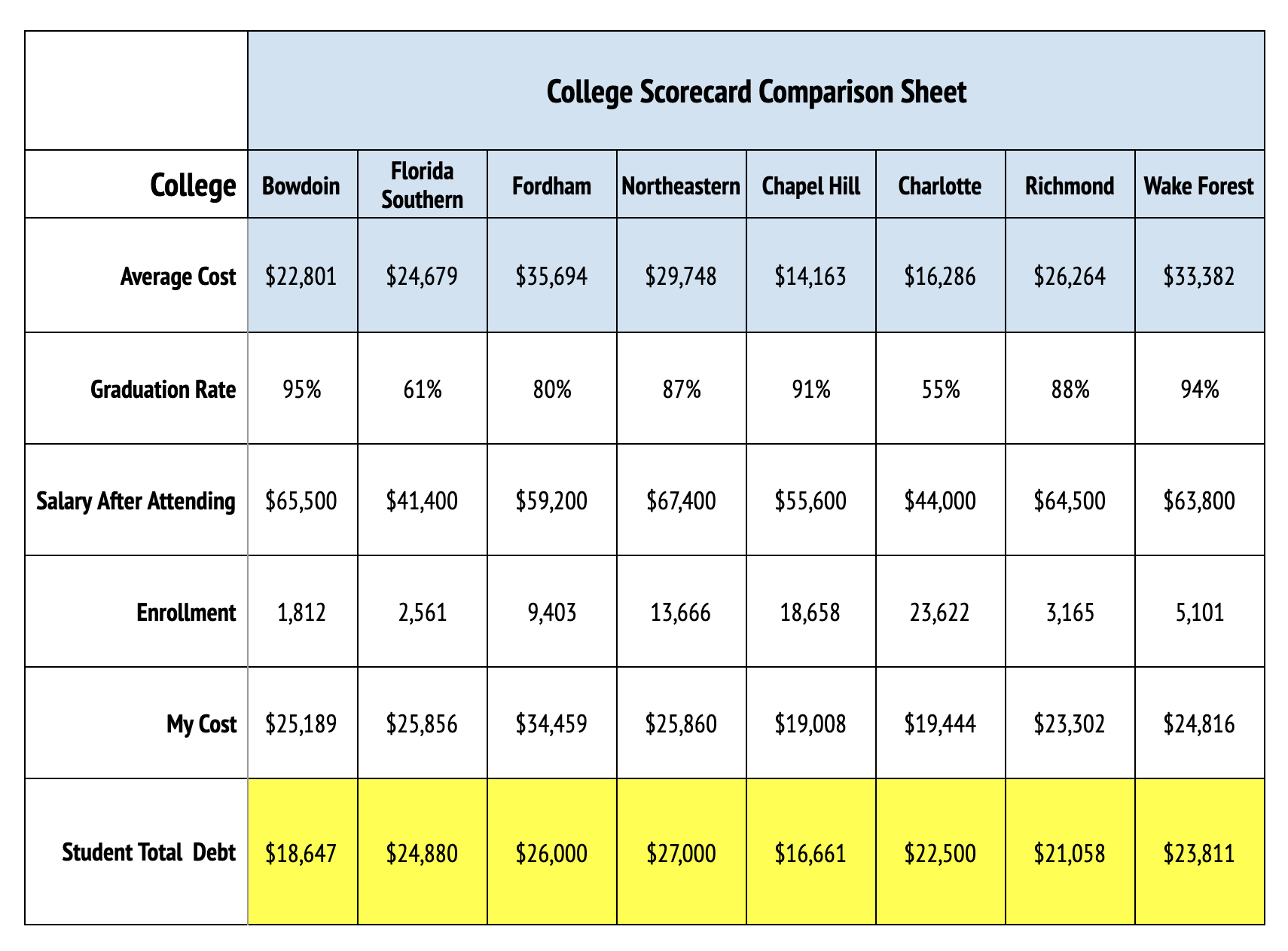

Following is an example of a completed College Scorecard Comparison Sheet.

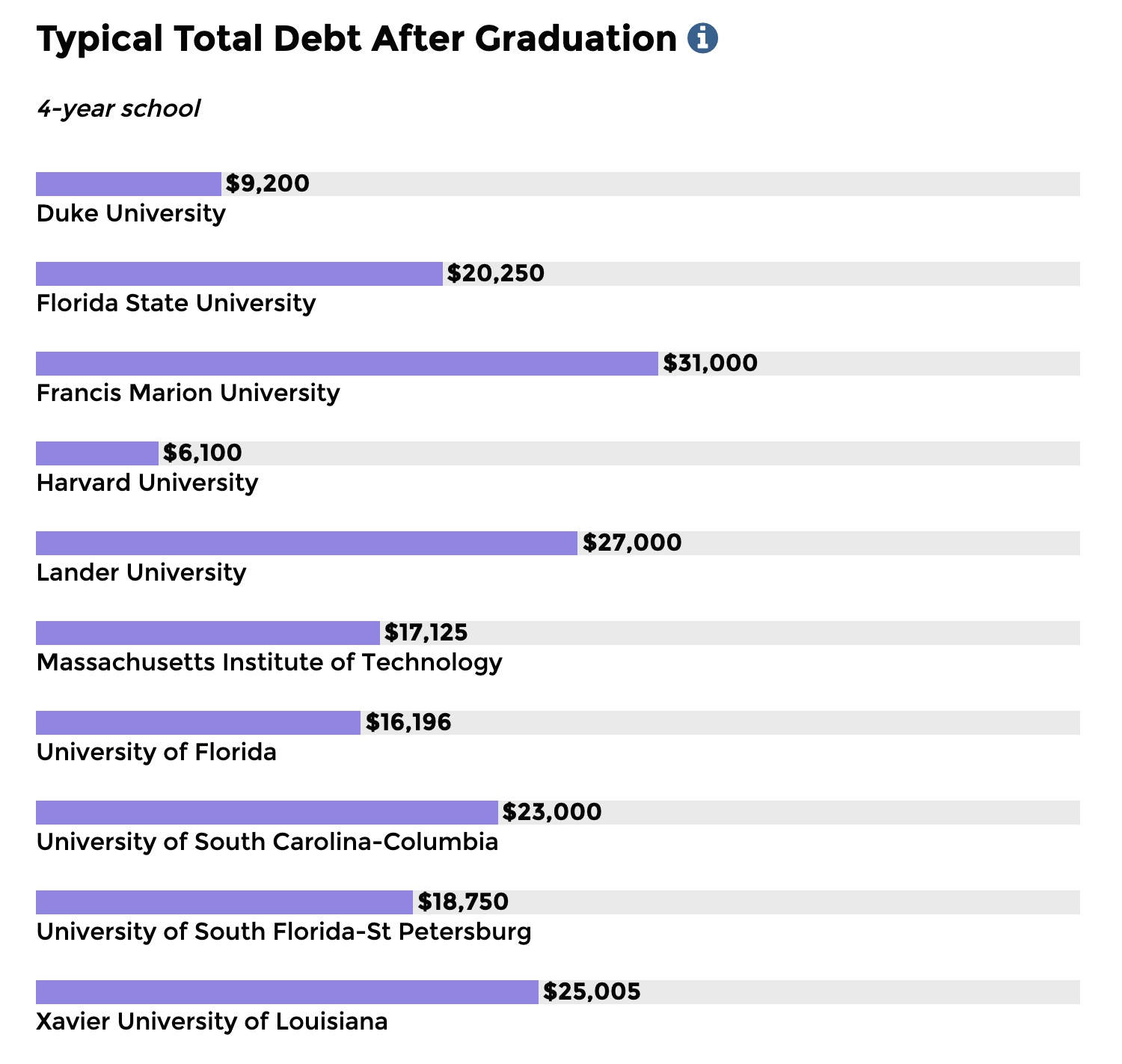

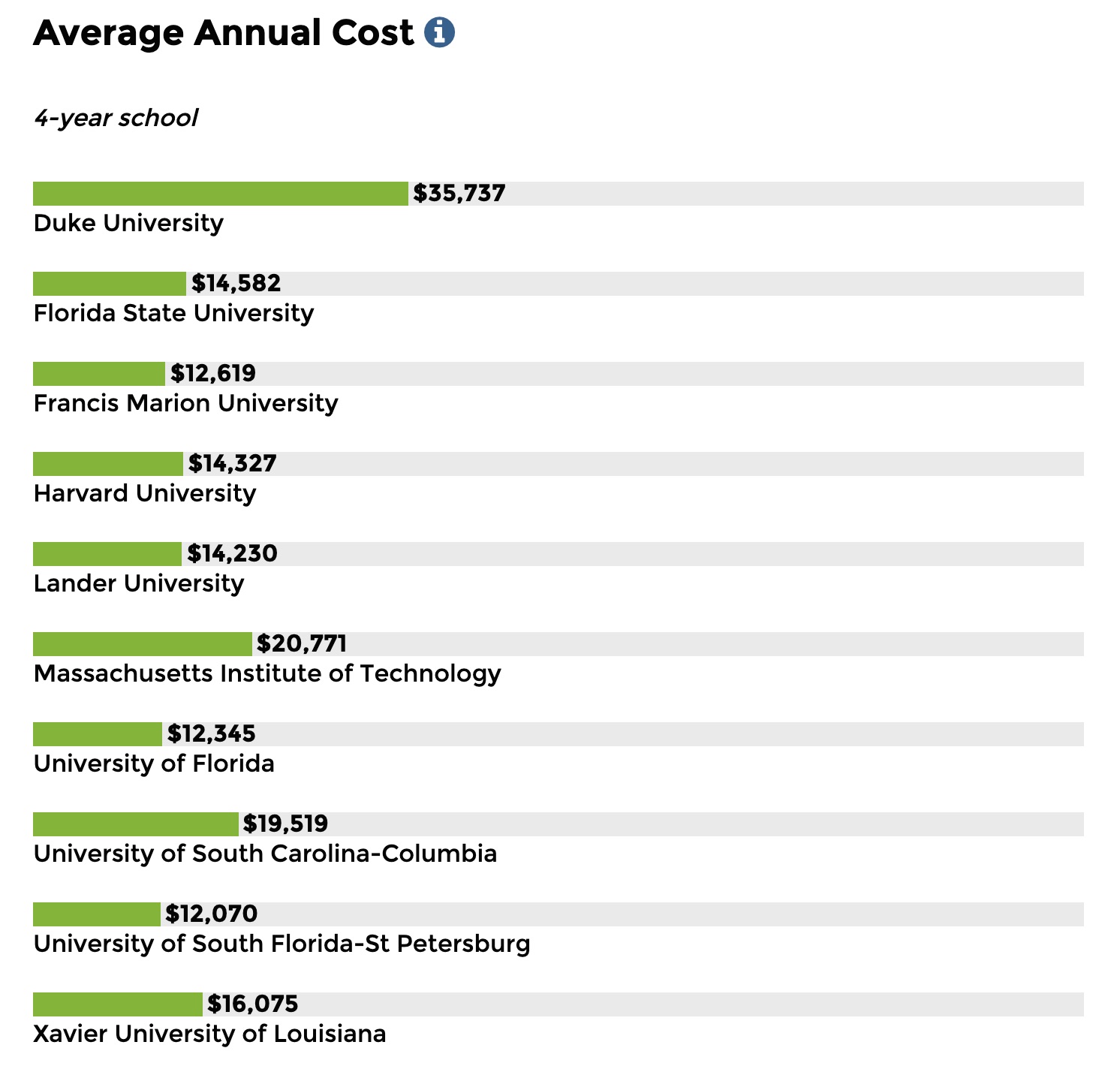

You will be able to compare up to ten colleges at a time in such areas as average annual cost, graduate rates, future salary, average debt, and the percentage of students who assume student loans. Below is an example of how widely average student loan debt varies by college, and particularly, how attending a seemingly less expensive college could result in a higher amount of student loan debt due to the differences in financial aid policies.

Step 3: Quick Comparison of Up to Ten Colleges: While you must complete the Net Price Calculator for each of your schools to gain a reasonably accurate net price, the US Department of Education’s College Affordability and Transparency Center provides some handy tools to assist in your college research and college planning. While the Net Price Calculator Center is one of those tools, let’s take a look at how to use the College Scorecard to quickly compare the estimated cost of your education and estimated salary upon graduation for 10 schools based on your family income.

- Click here to go to the College Scorecard website

- Select the ‘+’ next to Name to begin your search

- Enter the name of your first school

- Select your school from the list

- Click onto ‘FIND SCHOOLS’

- On the Results page, Select the ‘+’ in the box for the name of your school to add the school to your list of schools to compare

- Select ‘Edit Search’ at the top of the page and repeat the process for each school

- After selecting all of your schools, click onto ‘Compare’ at the top of the page

- Post the information for each school to your ‘College Scorecard Comparison Sheet’ for every area EXCEPT ‘My Cost’

- Expand the ‘Costs’ section by clicking onto the ‘+’

- Select your family income in the ‘What’s your family income?’ pull down menu

- Enter the amount for each of your school’s in the ‘My Cost’ area

Step 4: What is Your Cost? Compare ‘My Cost’ to the ‘Average Cost’ for each of your schools.

Want to compare more schools? If you return to the College Scorecard homepage, you may continue to search for colleges by programs/degrees, location, and size. Under the Advanced Search menu you may search for colleges by such areas as religious affiliation, gender, HBCU, Hispanic Serving, Asian, Native American, and Tribal Colleges.

It is not uncommon to find that, based on your family income, schools with a COA more than 2-3 times that of other schools will result in an estimated cost that is significantly less than a seemingly less costly school. This cost difference reflects the differences in the financial aid policies of each school and how the school allocates financial aid.

After using your College Scorecard research to further define your college list, continue to the Net Price Calculator (Step 5) to further understand how each of your colleges arrives at your net price.

Open your ‘Net Price Calculator’ document or click here to create a copy of the ‘Net Price Calculator’ document.

- Select the ‘File’ menu on the top left of the document.

- Select ‘Make a copy’ from the File Menu.

- Replace ‘Copy of Your Name’ in the name of the document with your first and last name (properly capitalized).

- Select ‘SHARE’ to confirm that the document has been shared to cpc@collegeplanningcohort.com. You may also add the email address of your parent, mentor, or college adviser.

Step 5: Find the Net Price Calculator for Your School: All U.S. colleges and universities accepting federal funds are required to provide a Net Price Calculator on their website. However, some colleges do not host their own Net Price Calculator and provide a link to the College Board or another service provider:

- You may find the Net Price Calculator for each of the colleges on your list on the college’s website, at the U.S. Department of Education’s Net Price Calculator Center, or at the College Board. Otherwise you may perform an Internet search as indicated below:

- If you cannot locate the Net Price Calculator on the college’s website, perform an Internet search on the phrase, “college name + net price calculator,” such as university of florida net price calculator, or university of south florida net price calculator.

- If your Internet search is not successful, you may go to the U.S. Department of Education Net Price Calculator Center

- If you have registered for the SAT and have a College Board Account, you should check the list of schools on the College Board website. Logging into your account and computing using the Net Price Calculator on the College Board’s website will allow you to save your information for each of your schools.

- If the 3 previous steps are not successful, you may visit the U.S. News & World Reports website (https://www.usnews.com/education/best-colleges/features/net-price-calculator), which provides links to the net price calculators for most U.S. National Universities and National Liberal Arts Colleges.

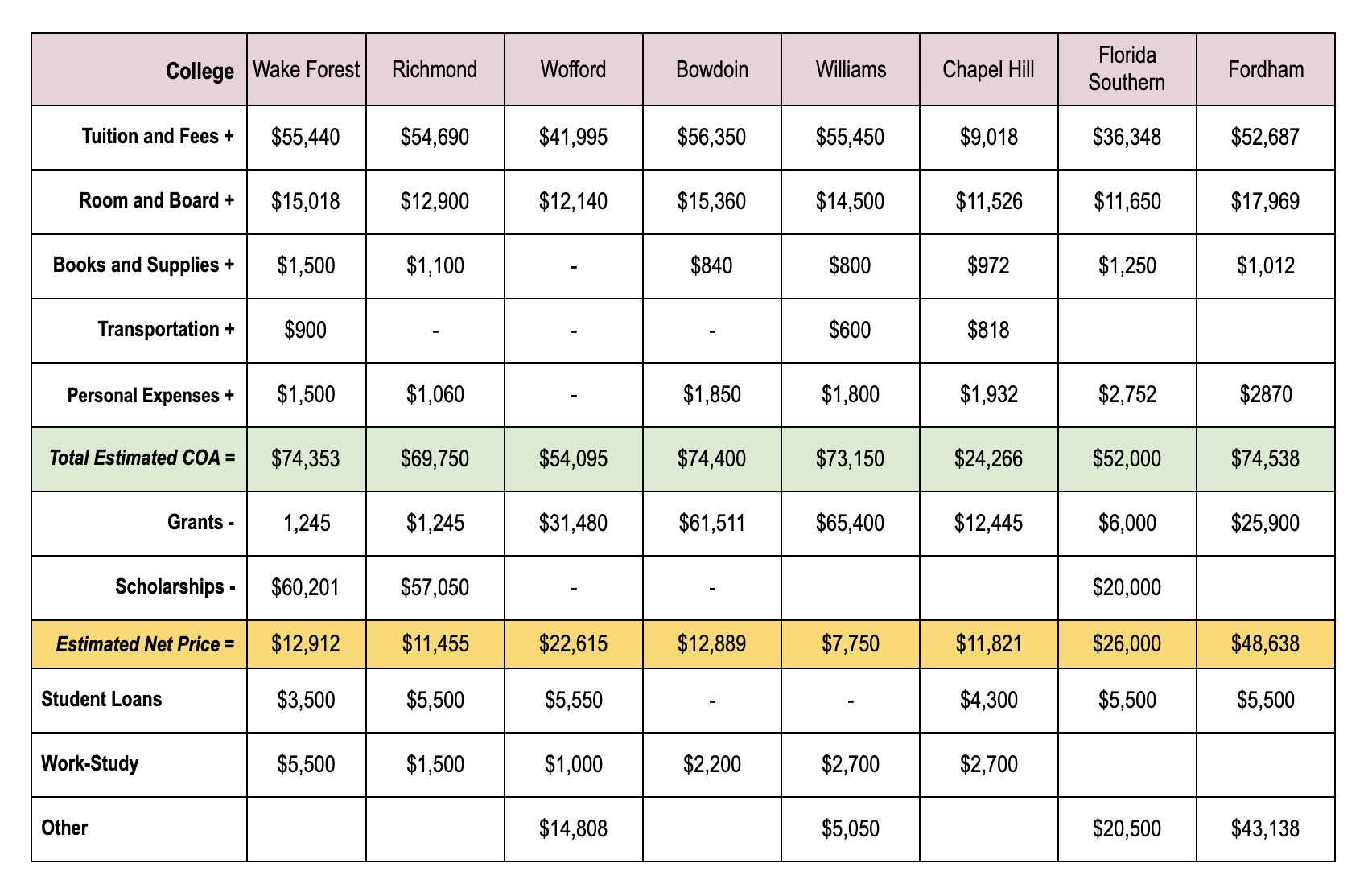

Following is an example of a completed Net Price Calculator form to illustrate how widely the net price may vary among institutions.

Step 6: Complete the Net Price Calculator: Complete each college’s Net Price Calculator by answering each of the questions. You are likely to require information from your parents for such questions as family income. After entering your information, most Net Price Calculators will calculate the following amounts:

- Estimated tuition and fees

- Estimated room and board charges

- Estimated costs of books and supplies

- Estimated other expenses (e.g., transportation, personal expenses)

- Estimated grant aid

- Estimated Federal sources of financial aid (i.e., Pell Grant, Work Study, and federal student loans)

Completing the Net Price Calculator as you are developing your college list, AND, prior to finalizing your college enrollment decision, can help you and your family from falling into the student loan trap.

The first video provides insight into the staggering amount of student loan debt being incurred by students and parents, and the long-term impact on the post-college lives of students who struggle to repay student loans and defer aspirations of marriage, buying a home, and pursuing the dreams and aspirations that led them to attend college.

The second video, produced by the Rapper Dee-1 about the student loan servicer, SalleMae, provides a humorous look at the student loan debt crisis, however, few students can plan to produce a rap video to pay off their student loans.

Completing the Net Price Calculator reveals the huge differences in financial aid policies from college to college and why attending an in-state public university with a state scholarship can cost far more than attending a private institutional offering generous amounts of institutional aid.

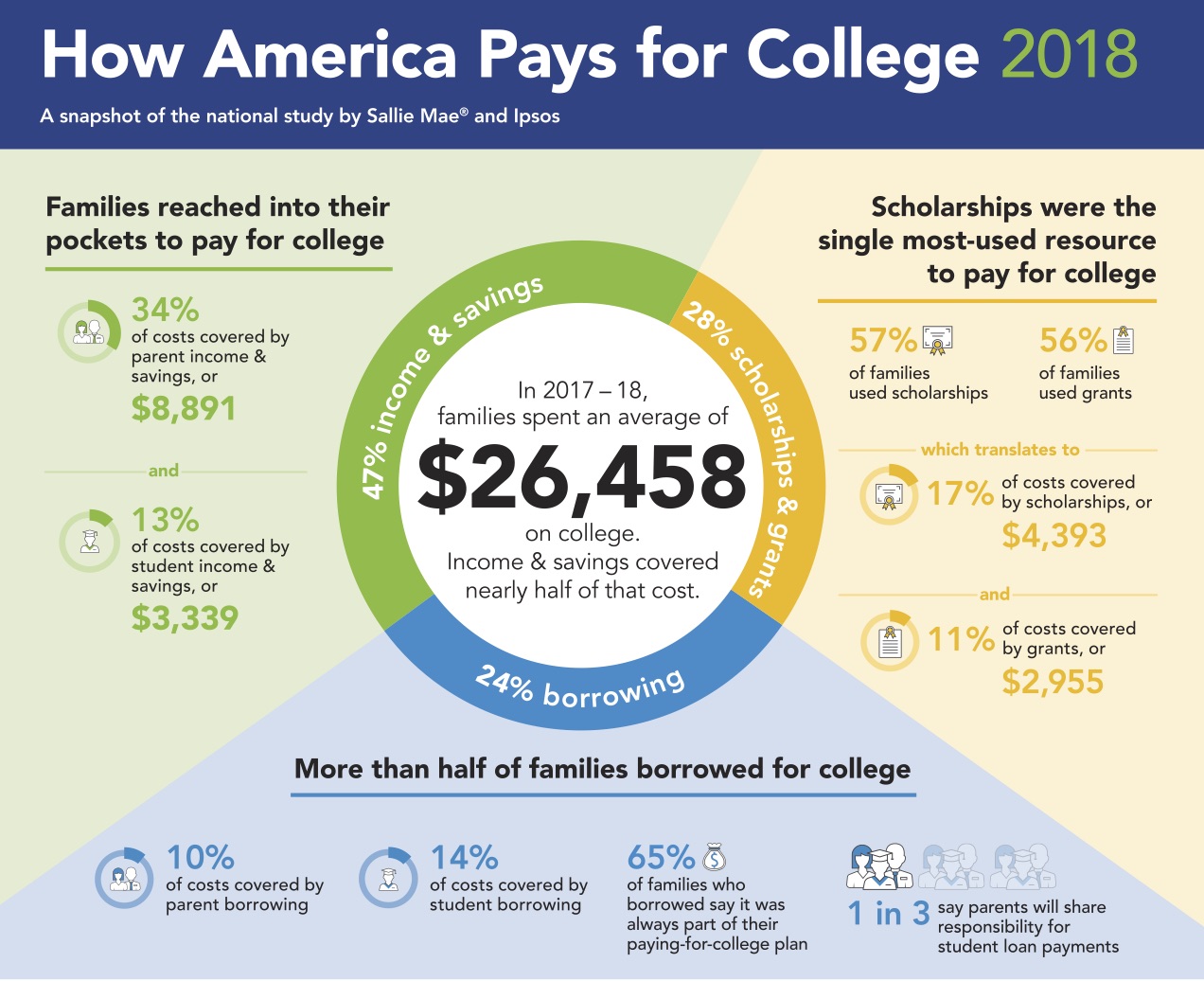

Despite the popularized belief that scholarship money is everywhere and that billions of dollars in scholarships go unclaimed each year, the reality is that the average student will only receive $4,393 in scholarships. Thousands of academically accomplished students lower income students, who fail to match to the right colleges, will assume a huge amount of student loan debt and their parents will assume a huge amount of Parent PLUS loan debt. However, thousands of academically accomplished students from middle income families will also fail to match to the right colleges and cost their parents tens of thousands of dollars in savings, or also be forced to incur student loan debt.

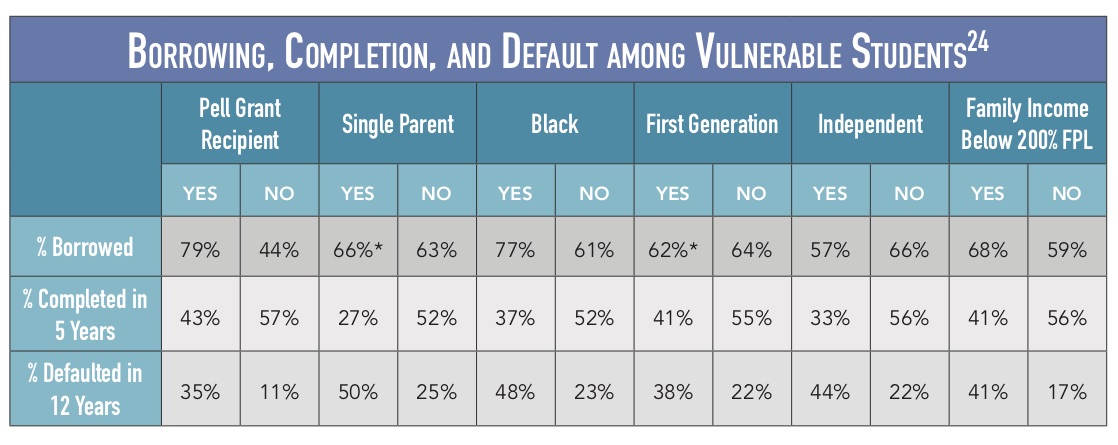

Quick explanation of the above table:

- Only 4 out of 10 students from lower-income families, single parent households, black, or first generation, graduate from college in 5 years, meaning that 6 out of 10 students will either assume more student loan debt to pay for the additional years of college, or they will drop out of college owing thousands of dollars in student loans.

- About 7 out 10 of these students take out student loans to pay for college.

- About 4 out of 10 of these students default on paying back their student loans, due to such reasons as being unable to pay the monthly cost or not making enough money in their jobs or careers.

Unfortunately, since a huge amount of student loan debt begins accruing interest while students are in college, and all student loan debt accrues interest after leaving college, the student loan debt of many students will rise to a level where they may never be paid off!

Step 7: Repeat Steps 3 and 4 for Each of Your Colleges: Complete the ‘Net Price Calculator’ form for each of your colleges. Your form includes 3 tables allowing you to estimate the net price for up to 32 colleges.

Note: Ensure that your list includes 2 safety schools: Your final college list should contain at least two safety schools where you have a high probability of being offered admission AND that are affordable to you and your family. For some students, this will mean at least one community or technical college and one in-state public university where they exceed the admission standard. Beyond these two schools, repeat this step for all other schools that you are adding to your final college list. You should have actual or estimated information required to complete this step through your research, The Net Price Calculator, from letters/emails received from the school, or from the school’s website.